Coast Area Manager from 2007 to 2009, and Special Projects Leader Technical Training Task from 2006 to 2007. Mr. Larson also serves as a director of Newpark Resources, Inc. Mr. Larson has been a director of Oceaneering since May 2017.

The Board has determined that Mr. Larson is qualified to serve on our Board based on his in-depth knowledge regarding our business, derived from his service as a member of our executive management team, and over 25 years of experience in the oilfield services industry. Mr. Larson is a member of the National Petroleum Council.

M. Kevin McEvoy

Mr. McEvoy, 67, served as Chief Executive Officer of Oceaneering from 2011 to May 2017. Mr. McEvoy joined Oceaneering in 1984, when we acquired Solus Ocean Systems, Inc. Since 1984, he held various senior management positions in each of our operating groups. He was appointed Executive Vice President in 2006, with the additional position of Chief Operating Officer in 2010, and President from 2011 to February 2015. Mr. McEvoy is also a director of EMCOR Group, Inc. Mr. McEvoy has been a director of Oceaneering since 2011.

The Board has determined that Mr. McEvoy is qualified to serve on our Board based on his thorough knowledge of Oceaneering and its businesses, which he gained through his years of service in each of our five business segments and as a member of our executive management team, as well as through his prior service on our Board. Mr. McEvoy has over 40 years of experience in offshore, diving and other subsea and marine-related activities, primarily in oilfield-related areas, with significant international exposure.

Paul B. Murphy, Jr.

Mr. Murphy, 58, has, since 2010, been Chief Executive Officer and chairman of the board of directors of Cadence Bancorporation and Chief Executive Officer of Cadence Bancorp, LLC, which formed Cadence Bank in 2009. Cadence Bancorporation is a regional bank holding company headquartered in Houston, Texas. Mr. Murphy previously was employed by Amegy Bank of Texas from 1990 to 2009, where he served in senior leadership roles, including as Chief Executive Officer from 2000 to 2009 and as a director of that bank from 1994 to 2009. Mr. Murphy also serves as a director of GP Natural Resource Partners LLC, the general partner of Natural Resource Partners L.P., and as a director of Hines Real Estate Investment Trust, Inc. He served as a director of the Federal Reserve Bank of Dallas – Houston Branch from 2009 through 2015. Mr. Murphy has been a director of Oceaneering since August 2012. He is chairman of the Audit Committee and a member of the Nominating and Corporate Governance Committee.

The Board has determined that Mr. Murphy is qualified to serve on our Board based on his considerable experience as an executive officer and director of both privately owned and publicly traded companies, particularly financial institutions. Mr. Murphy’s financial background, including over 35 years of business and entrepreneurial experience in the financial services industry, allows him to provide valuable contributions to our Board. Including his service on our Board, Mr. Murphy has over 20 years of experience as a director of publicly owned companies.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of shares of Common Stock beneficially owned as of March 21, 201820, 2024, by each director and nominee for director, each of the executive officers named in the Summary Compensation Table in this Proxy Statement, and all directors and executive officers as a group. Except as otherwise indicated, each individual named has sole voting and dispositive power with respect to the shares shown. | | | | | | | | | | | | | | | | | | | | |

| Name | | Number of

Shares (1) | | Number of

Shares Underlying

Restricted Stock

Units (2) | | Total (3) |

| Karen H. Beachy | | 22,786 | | | — | | | 22,786 | |

| William B. Berry | | 78,202 | | | — | | | 78,202 | |

| Earl F. Childress | | 36,054 | | | 36,373 | | | 72,427 | |

| Alan R. Curtis | | 89,129 | | | 100,403 | | | 189,532 | |

| Deanna L. Goodwin | | 19,899 | | | — | | | 19,899 | |

| Roderick A. Larson | | 339,140 | | | 302,046 | | | 641,186 | |

| Martin J. McDonald | | 74,301 | | | 41,589 | | | 115,890 | |

| M. Kevin McEvoy | | 138,530 | | | — | | | 138,530 | |

| Paul B. Murphy, Jr. | | 65,910 | | | — | | | 65,910 | |

| Reema Poddar | | — | | | — | | | — | |

| Jon Erik Reinhardsen | | 78,202 | | | — | | | 78,202 | |

| Jennifer F. Simons | | — | | | 83,358 | | | 83,358 | |

| Steven A. Webster | | 142,933 | | | — | | | 142,933 | |

| All directors and executive officers as a group (20 persons) | | 1,272,458 | | | 716,934 | | | 1,989,392 | |

(1)Includes the following share equivalents, which are fully vested but are held in trust pursuant to the Oceaneering Retirement Investment Plan (the “401(k) Plan”), as to which the indicated persons have the right to direct the plan trustee on how to vote: Mr. Curtis – 14,318; and all directors and executive officers as a group – 69,018. At withdrawal, the share equivalents in the 401(k) Plan are to be settled in shares of Common Stock. Also includes the following shares as to which the indicated person has shared voting and dispositive power: Mr. Larson – 310,268. The beneficial ownership of (a) each director and executive officer represents 0.3% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represents 1.3% of the outstanding Common Stock. There are no outstanding stock options held by any of our directors or executive officers.

(2)Includes shares of Common Stock that are represented by restricted stock units of Oceaneering that are credited to the accounts of certain individuals and are subject to vesting. The individuals have no voting or investment power over these restricted stock units.

(3)The indicated shares of Common Stock and Common Stock underlying restricted stock units of (a) each director and executive officer represent 0.6% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represent 2.0% of the outstanding Common Stock.

|

| | | | | | | | | |

| Name | | Number of

Shares (1) | | Number of

Shares Underlying

Restricted Stock

Units (2) | | Total (3) |

| Stephen P. Barrett | | 13,311 |

| | 31,816 |

| | 45,127 |

|

| William B. Berry | | 18,000 |

| | — |

| | 18,000 |

|

| T. Jay Collins | | 37,452 |

| | — |

| | 37,452 |

|

| Alan R. Curtis | | 16,551 |

| | 35,253 |

| | 51,804 |

|

| Deanna L. Goodwin | | 8,000 |

| | — |

| | 8,000 |

|

| Clyde W. Hewlett | | 44,790 |

| | 58,545 |

| | 103,335 |

|

| John R. Huff | | 110,196 |

| | — |

| | 110,196 |

|

| Roderick A. Larson | | 29,555 |

| | 132,233 |

| | 161,788 |

|

| David K. Lawrence | | 13,840 |

| | 29,298 |

| | 43,138 |

|

| M. Kevin McEvoy | | 173,670 |

| | 71,055 |

| | 244,725 |

|

| Paul B. Murphy, Jr. | | 23,000 |

| | — |

| | 23,000 |

|

| Jon Erik Reinhardsen | | 18,000 |

| | — |

| | 18,000 |

|

| Steven A. Webster | | 22,000 |

| | — |

| | 22,000 |

|

| All directors and executive officers as a group (18 persons) | | 611,511 |

| | 442,267 |

| | 1,053,778 |

|

| |

(1) | There are no outstanding stock options held by any of our directors or executive officers. Includes the following shares granted in 2018 pursuant to restricted stock award agreements, as to which the recipient has sole voting power and no dispositive power: Mr. Berry – 8,000; Mr. Collins – 8,000; Ms. Goodwin – 8,000; Mr. Huff – 13,000; Mr. McEvoy – 8,000; Mr. Murphy – 8,000; Mr. Reinhardsen – 8,000; Mr. Webster – 8,000; and all directors and executive officers as a group – 69,000. Also includes the following share equivalents, which are fully vested but are held in trust pursuant to the Oceaneering Retirement Investment Plan (the “401(k) Plan”), as to which the indicated persons have the right to direct the plan trustee on how to vote: Mr. Barrett – 1,635; Mr. Curtis – 10,865; Mr. Hewlett – 286; Mr. Lawrence – 2,039; Mr. McEvoy – 31,739; and all directors and executive officers as a group – 59,556. At withdrawal, the share equivalents in the 401(k) Plan are to be settled in shares of Common Stock. Also includes 1,620 shares as to which one of our executive officers has shared voting and dispositive powers; however, there are no shares over which any of our directors or the Named Executive Officers has such powers. The beneficial ownership of (a) each director and executive officer represents 0.2% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represents 0.6% of the outstanding Common Stock. |

| |

(2) | Includes shares of Common Stock that are represented by restricted stock units of Oceaneering that are credited to the accounts of certain individuals and are subject to vesting. The individuals have no voting or investment power over these restricted stock units. |

| |

(3) | The indicated shares of Common Stock and Common Stock underlying restricted stock units of (a) each director and executive officer represent 0.2% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represent 1.1% of the outstanding Common Stock. |

Listed below are the only persons who, to our knowledge, may be deemed to be beneficial owners as of March 21, 201820, 2024, of more than 5% of the outstanding shares of Common Stock. This information is based on beneficial ownership reports filed with the U.S. Securities and Exchange Commission (the “SEC”). | | | | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent

of Class (1) |

BlackRock, Inc.

50 Hudson Yards

New York, NY 10001 | | 16,015,288 | (2) | | 15.8 | % |

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | 12,461,454 | (3) | | 12.3 | % |

EARNEST Partners, LLC

1180 Peachtree Street NE, Suite 2300

Atlanta, GA 30309 | | 5,166,012 | (4) | | 5.1 | % |

State Street Corporation

State Street Financial Center

1 Congress Street, Suite 1

Boston, MA 02114-2016 | | 5,042,866 | (5) | | 5.0 | % |

(1)All percentages are based on the total number of issued and outstanding shares of Common Stock as of March 20, 2024. |

| | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent

of Class (1) |

FMR LLC

245 Summer Street

Boston, MA 02210 | | 14,741,834 | (2) | | 15.0 | % |

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | 8,701,142 | (3) | | 8.8 | % |

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055 | | 8,401,374 | (4) | | 8.5 | % |

Dimensional Fund Advisors LP

Building One

6300 Bee Cave Road

Austin, TX 78746 | | 5,941,287 | (5) | | 6.0 | % |

| |

(1) | All percentages are based on the total number of issued and outstanding shares of Common Stock as of March 21, 2018. |

| |

(2) | The amount beneficially owned of 14,741,834 shares of Common Stock, as shown, is as reported by FMR LLC in a Schedule 13G/A filed with the SEC on February 13, 2018. The Schedule 13G/A reports that FMR LLC has sole voting power with respect to 991,486 shares and sole dispositive power with respect to all 14,741,834 shares. The Schedule 13G/A identifies FMR LLC as a parent holding company and identifies the relevant subsidiaries of FMR LLC collectively and beneficially owning the shares being reported in the Schedule 13G/A as: FIAM LLC; Fidelity Institutional Asset Management Trust Company; FMR Co., Inc.; and Strategic Advisers, Inc. The Schedule 13G/A further reports: (i) FMR Co., Inc. is the beneficial owner of 5% or greater of the Common Stock outstanding; (ii) Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC; (iii) members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of the voting equity of FMR LLC; (iv) the Johnson family group and other equity owners of FMR LLC have entered into a voting agreement; (v) through their ownership of voting equity and the execution of the voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, as amended (the “Investment Company Act”), to form a controlling group with respect to FMR LLC; (vi) neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ boards of trustees; and (vii) Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ boards of trustees. The Schedule 13G/A disclaims reporting on shares, if any, beneficially owned by certain subsidiaries, affiliates or other companies whose beneficial ownership of shares is disaggregated from that of FMR LLC in accordance with SEC Release No. 34-39538 (January 12, 1998). |

| |

(3) | The amount beneficially owned of 8,701,142 shares of Common Stock, as shown, is as reported by The Vanguard Group in a Schedule 13G/A filed with the SEC on February 9, 2018. The Schedule 13G/A reports that The Vanguard Group has sole voting power with respect to 51,913 shares, sole dispositive power with respect to 8,645,103 shares, shared voting power with respect to 11,371 shares and shared dispositive power with respect to 56,039 shares. The Schedule 13G/A further reports that: (i) Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 44,668 shares, or 0.05% of the Common Stock outstanding, as a result of its serving as investment manager of collective trust accounts; and (ii) Vanguard Investments Australia, Ltd., a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 18,616 shares, or 0.02% of the Common Stock outstanding, as a result of its serving as investment manager of Australian investment offerings. |

| |

(4) | The amount beneficially owned of 8,401,374 shares of Common Stock, as shown, is as reported by BlackRock, Inc. in a Schedule 13G/A filed with the SEC on January 29, 2018. The Schedule 13G/A reports that BlackRock, Inc. has sole voting power with respect to 7,990,019 shares and sole dispositive power with respect to 8,401,374 shares. |

| |

(5) | The amount beneficially owned of 5,941,287 shares of Common Stock, as shown, is reported by Dimensional Fund Advisors LP in a Schedule 13G filed with the SEC on February 9, 2018. The Schedule 13G reports that Dimensional Fund Advisors LP has sole voting power with respect to 5,766,285 shares and sole dispositive power with respect to |

5,941,287(2)The amount beneficially owned of 16,015,288 shares of Common Stock, as shown, is as reported by BlackRock, Inc. in a Schedule 13G/A filed with the SEC on January 22, 2024. The Schedule 13G/A reports that BlackRock, Inc. has sole voting power with respect to 15,777,722 shares and sole dispositive power with respect to 16,015,288 shares. The Schedule 13G13G/A further reports that: (i) Dimensional(a) BlackRock Fund Advisors, LP, an investment adviser registered under Section 203a subsidiary of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”); (ii) in certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds; (iii) in its role as investment advisor, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) may possess voting and/or investment power over the shares that are owned by the Funds, and may be deemed to beBlackRock, Inc., is the beneficial owner of such shares, however, all5% or greater of the Common Stock outstanding; and (b) iShares Core S&P Small-Cap ETF has the power to direct the receipt of dividends from, or the proceeds from the sale of the Common Stock of, 5% or more of the Common Stock outstanding.

(3)The amount beneficially owned of 12,461,454 shares of Common Stock, as shown, is as reported by The Vanguard Group in a Schedule 13G/A filed with the SEC on February 13, 2024. The Schedule 13G are13G/A reports that The Vanguard Group has sole voting power with respect to zero shares, sole dispositive power with respect to 12,177,878 shares, shared voting power with respect to 189,022 shares and shared dispositive power with respect to 283,576 shares.

(4)The amount beneficially owned of 5,166,012 shares of Common Stock, as shown, is as reported by EARNEST Partners, LLC in a Schedule 13G/A filed with the Funds;SEC on March 11, 2024. The Schedule 13G/A reports that EARNEST Partners, LLC has sole voting power with respect to 3,005,598 shares and (iv) Dimensional disclaims beneficial ownershipsole dispositive power with respect to 5,166,012 shares.

(5)The amount beneficially owned of such5,042,866 shares of Common Stock, as shown, is as reported by State Street Corporation in a Schedule 13G/A filed with the SEC on January 24, 2024. The Schedule 13G/A reports that State Street Corporation has sole voting power with respect to zero shares, sole dispositive power with respect to zero shares, shared voting power with respect to 4,701,870 shares and shared dispositive power with respect to 5,042,866 shares.

CORPORATE GOVERNANCE

During 2017,2023, our Board of Directors held eightfive meetings of the full Board and 1715 meetings of committees of the Board. Each of our continuing directors attended at least 75% of the aggregate number of meetings of the Board and meetings of committees of the Board on which hethey served (during the period of his service). All directors are invited to attend all meetings of the committees of the Board. In 2023, no committee meetings were scheduled or held concurrently; as a result, most directors attended most or all of the committee meetings regardless of whether they served on the committees. In addition, we have a policy that directors are encouraged to attend the Annual Meeting. Last year, all of our directors except Messrs. Berry and Reinhardsen attended our Annual Meeting. In 2017,2023, the nonemployee directors met in regularly scheduled executive sessions without management present, and similar sessions are scheduled for 2018. The chairmen2024. Under our Corporate Governance Guidelines, the chairs of the Audit Committee, Compensation CommitteeBoard and Nominating and Corporate Governance CommitteeCommittees chair these executive sessions on a rotating basis. sessions.

Interested parties may communicate directly with the nonemployee directors by sending a letter to the “Board of Directors (Independent Members),” c/o Corporate Secretary, Oceaneering International, Inc., 11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-3000.77086.

Under rules adopted by the New York Stock Exchange (the “NYSE”), our Board of Directors must have a majority of independent directors. The director independence standards of the NYSE require a board determination that ouran independent director hashave no material relationship with us and has no specific relationships that preclude independence. Our Board considers relevant facts and circumstances in assessing whether a director is independent. Our Board has determined that, with the exception of Mr. Larson, all of our directors currently meet the NYSE independence requirements.

We have three standing committees of our Board, of Directors: the Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. composed as follows: | | | | | | | | | | | | | | | | | | | | |

| Director | | Audit

Committee | | Compensation

Committee | | Nominating, Corporate Governance and Sustainability Committee |

| Karen H. Beachy | | Member | | Member | | |

| William B. Berry | | | | Member | | |

| Deanna L. Goodwin | | Member | | Chair | | |

| Paul B. Murphy, Jr. | | Chair | | | | Member |

| Reema Poddar | | | | | | Member |

| Jon Erik Reinhardsen | | | | Member | | Member |

| Steven A. Webster | | | | | | Chair |

Our Board has determined that each member of these committees is independent in accordance with the requirements of the NYSE. Our Board has also determined that each member of the Audit Committee meets the independence requirements that the SEC has established for service on an audit committee.

COMMITTEES OF THE BOARD

Audit Committee

The Audit Committee, which is comprised of Messrs.directors Murphy (Chairman)(Chair), BerryBeachy and Reinhardsen,Goodwin, held eightseven meetings during 2017. Effective February 2018, Ms. Goodwin replaced Mr. Reinhardsen as a member of the Audit Committee.2023.

Our Board of Directors has determined that Ms. Goodwin and Mr. Murphy are audit committee financial experts and that all current members of the Audit Committee are audit committee financial expertsfinancially literate, as defined in the applicable rules of the SEC.SEC and the NYSE. For information relating to the background of each member of the Audit Committee, see the biographical information under “Information about Nominees for Election and Continuing Directors.”

The Audit Committee is appointed by our Board, of Directors, on the recommendation of the Nominating, and Corporate Governance and Sustainability Committee, to assist the Board in its oversight of:

•the integrity of our financial statements;

•our compliance with applicable legal and regulatory requirements;

•the independence, qualifications and performance of our independent auditors;

•the performance of our internal audit functions; and

•the adequacy of our internal control over financial reporting.

Our management is responsible for our internal controls and preparation of our consolidated financial statements. Our independent auditors are responsible for performing an independent audit of the consolidated financial statements and internal controls over financial reporting and issuing reports thereon. The Audit Committee is responsible for overseeing the conduct of these activities and appointing our independent auditors. The Audit Committee operates under a written charter adopted by our Board of Directors.Board. As stated above and in the Audit Committee Charter,charter, the Audit Committee’s responsibility is one of oversight. The Audit Committee is not providing any expert or special assurance as to Oceaneering’s financial statements or any professional certification as to the independent auditors’ work.

The Audit Committee annually reviews the performance and independence of the independent auditors in deciding whether to retain the current independent auditors or engage a different independent registered public accounting firm for the ensuing year. In the course of these reviews, the Audit Committee considers, among other things, the independent auditors’ general qualifications; historical quality of service provided to us; sufficiency of resources; quality of communication and interaction; and independence, objectivity and professional skepticism. The Audit Committee also considers whether, in order to assure continuing auditor independence, there should be regular rotation of the independent registered public accounting firm acting as our independent auditor, which includes consideration of the advisability and potential impact of selecting a different independent registered public accounting firm.

In discharging its duties, the Audit Committee also reviews and approves the scope of the annual audit, non-audit services to be performed by the independent auditors, and the independent auditors’ audit and non-audit fees; reviews and discusses with management (including the senior internal auditor) and the independent auditors’ annual audit of our internal control over financial reporting; recommends to our Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for filing with the SEC; meets independently with our senior compliance and internal auditors,audit personnel, independent auditors and management; reviews, among other things, the general scope of our accounting, financial reporting, annual audit and our internal audit programs and matters relating to internal control systems, information technology and cybersecurity, legal and regulatory matters and taxes, as well as the use of any “non-GAAP financial measures” (including environmental, social, and

governance measures and metrics) and the results of the annual audit and interim financial statements, auditor independence issues and the adequacy of the Audit Committee charter; and reviews with management and the independent auditors any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding our financial statements or accounting policies.

A copy of the Audit Committee charter is available under the Governance tab in the GovernanceInvestors section under Investor Relations onof our Web sitewebsite (www.oceaneering.com). Any shareholder may obtain a written copy of the charter from us upon request. The report of the Audit Committee is included in this Proxy Statement under the heading “Report of the Audit Committee.”

Compensation Committee

The Compensation Committee, comprised of Messrs.directors Goodwin (Chair), Beachy, Berry (Chairman),and Reinhardsen, and Webster, held four meetings during 2017. Effective February 2018, Ms. Goodwin replaced Mr. Webster as a member of the Compensation Committee.2023.

The Compensation Committee is appointed by our Board of Directors to:

•assist the Board in discharging its responsibilities relating to: (i)to (1) compensation of our executive officers and nonemployee directors;directors and (ii)(2) employee benefit plans and practices; and

•produce or assist management with the preparation of any reports that may be required from time to time by the rules of the NYSE or the SEC to be included in our proxy statements for our annual meetings of shareholders or annual reports on Form 10-K.

Specific duties and responsibilities of the Compensation Committee include:

•overseeing our executive and key employee compensation plans and benefit programs;

•reviewing and approving objectives relevant to the compensation of executives and key employees, including administrationemployees;

•administering our short-term and long-term incentive plans,plans;

•administering our supplemental executive retirement plan andplan;

•administering our severance, termination and change-of-control arrangements;

•approving employment agreements for key executives;

•reviewing and making recommendations to the Board regarding the directors’ and officers’ indemnification and insurance matters;

•evaluating the performance of executives and key employees, including our Chief Executive Officer;

•recommending to the Board the compensation for the Board and committees of the Board;

•administering the Company’s clawback policy; and

•annually evaluating its own performance and its charter.

On an annual basis, the Compensation Committee engages a recognized human resourceexecutive compensation consulting firm (the “Compensation Consultant”) to assist the Compensation Committee in its administration of compensation for our directors and executive officers. The Compensation Consultant provides to the Compensation Committee a market analysis including: (i)including total direct compensation (salary, annual incentive bonus and long-term incentive compensation), retirement benefits and perquisites for each of our executive officers and certain other key employees; and (ii) compensation for nonemployee directors among peer group companies and other survey data (see “Compensation Discussion and Analysis – The Role of the Compensation Consultant” in this Proxy Statement). The Compensation Consultant engaged in 2017, as in 2016 and 2015,2023 was Meridian Compensation Partners, LLC (“Meridian”)., which has served in this capacity since 2015.

The Compensation Committee approves the forms and amounts of annual and long-term incentive program compensation for our executive officers and other key employees, and recommends to the Board the forms and amounts of compensation for nonemployee directors.

The Compensation Committee operates under a written charter adopted by our Board of Directors.Board. A copy of the Compensation Committee charter is available under the Governance tab in the GovernanceInvestors section under Investor Relations onof our Web sitewebsite (www.oceaneering.com). Any shareholder may obtain a written copy of the charter from us upon request. The report of the Compensation Committee is included in this Proxy Statement under the heading “Report of the Compensation Committee.”

Nominating, and Corporate Governance and Sustainability Committee

The Nominating, and Corporate Governance and Sustainability Committee (the “Governance & Sustainability Committee”), comprised of Messrs.directors Webster (Chairman)(Chair), Murphy, and Reinhardsen, held fivefour meetings during 2017.2023. Ms. Poddar was appointed to the Governance and Sustainability Committee in February 2024.

The Nominating and Corporate Governance & Sustainability Committee is appointed by our Board of Directors to, among other things:

•consider and recommend to the Board the Qualifications that should be represented on the Board for appropriate oversight and advancement of Oceaneering’s long-term strategy;

•identify individuals qualified to become directors of Oceaneering;

•recommend to our Board candidates to fill vacancies on our Board or to stand for election to the Board by our shareholders;

•recommend to our Board a director to serve as ChairmanChair of the Board;

•recommend to our Board committee assignments for directors;

•periodically assess the performance of our Board and its committees;

•periodically review with our Board succession planning with respect to our Chief Executive Officer and other executive officers;

•monitor and advise the Board regarding environmental, corporate social responsibility, sustainability and governance (collectively, “ESG”) matters and have oversight responsibility for Oceaneering’s public reporting on ESG matters;

•monitor emerging issues potentially affecting the reputation of Oceaneering and the industries in which Oceaneering has significant operations;

•monitor and advise the Board regarding public policy issues, including Oceaneering’s political contributions policies and practices and lobbying priorities and activities;

•evaluate related-person transactions in accordance with our policy regarding such transactions; and

•periodically review and assess the adequacy of our corporate governance policies and procedures.

The Nominating and Corporate Governance & Sustainability Committee operates under a written charter adopted by our Board of Directors.Board. A copy of this charter and a copy of our Corporate Governance Guidelines are available under the Governance tab in the GovernanceInvestors section under Investor Relations onof our Web sitewebsite (www.oceaneering.com). Any shareholder may obtain a written copy of each of these documents from us upon request.

The Nominating and Corporate Governance & Sustainability Committee solicits ideas for potential Board candidates from a number of sources, including members of our Board of Directors and our executive officers. The Committee also has authorityrelies on and compensates third-party search firms to selectidentify qualified and compensatediverse potential Board candidates who might not be in the networks of members of our Board and our executive officers.

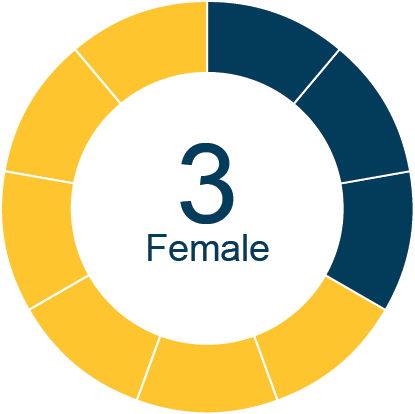

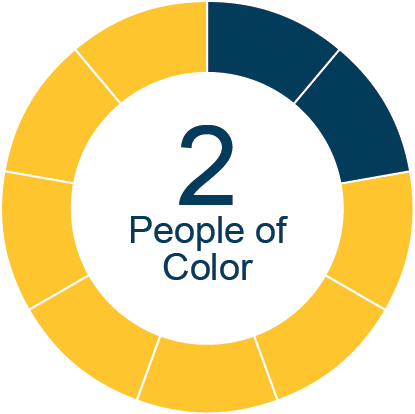

In assessing the Qualifications of all prospective nominees to the Board, the Governance & Sustainability Committee will consider, in addition to criteria set forth in our Bylaws, each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of Oceaneering and its shareholders. Consideration also will be given to the Board’s diversity and having an appropriate mix of backgrounds and skills. In that regard, our Corporate Governance Guidelines provide that any search for potential director candidates should consider diversity as to gender, ethnic background, and personal and professional experiences; any initial list of new director candidates developed by the Governance & Sustainability Committee, or by a third-party search firmconsultant engaged by or on behalf of the committee, to help identify candidates, if it deems it advisable to do so.fill any vacancy in Board membership should include qualified women and minority candidates. It is the sense of the Governance & Sustainability of the Committee that, consistent with shareholder feedback, the Board should reflect at least 30% gender, ethnic, and/or racial diversity.

Shareholder Nominations for Board Candidates

The Nominating and Corporate Governance & Sustainability Committee will also consider nominees recommended by shareholders in accordance with our Bylaws. In assessing the qualifications of all prospective nominees to the Board, the Nominating and Corporate Governance Committee will consider, in addition to criteria set forth in our Bylaws, each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of Oceaneering and its shareholders. Consideration also will be given to the Board’s diversity and having an appropriate mix of backgrounds and skills. In that regard, our Corporate Governance Guidelines provide that any search for potential director candidates should consider diversity as to gender, ethnic background and personal and professional experiences and that any initial list of new director candidates developed by the Nominating and Corporate Governance Committee, or by a third-party consultant engaged by or on behalf of the Nominating and Corporate Governance Committee, to fill any vacancy in Board membership should include one or more qualified women and minority candidates.

A shareholder who wishes to recommend a nominee for director should comply with the procedures specified in our Bylaws, as well as applicable securities laws and regulations of the NYSE. The Nominating and Corporate Governance & Sustainability Committee will consider all candidates identified through the processes described above, whether identified by the Nominating and Corporate Governance Committeecommittee or by a shareholder, and will evaluate each of them on the same basis.

As to each person a shareholder proposes to nominate for election as a director, our Bylaws provide that the nomination notice must:

•include the name, age, business address, residence address (if known) and principal occupation or employment of that person, the number of shares of Common Stock beneficially owned or owned of record by that person and any other information relating to that person that is required to be disclosed under Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the related SEC rules and regulations; and

•be accompanied by the written consent of the person to be named in the proxy statement as a nominee and to serve as a director if elected.

The nomination notice must also include, as to that shareholder and any of that shareholder’s “associates” (defined to include (i)(1) any person acting in concert with that shareholder, (ii)(2) any person who beneficially owns shares of Common Stock owned of record or beneficially by that shareholder and (iii)(3) any person

controlling, controlled by or under common control with, directly or indirectly, that shareholder or any person described in the foregoing clause (i)(1) or (ii)(2)) on whose behalf the nomination or nominations are being made:

•the name and address of that shareholder, as they appear on our stock records and the name and address of that associate;

•the number of shares of Common Stock which that shareholder and that associate own beneficially or of record;

•a description of any agreement, arrangement or understanding relating to any hedging or other transaction or series of transactions (including any derivative or short position, profit interest, option, hedging transaction or borrowing or lending of shares) that has been entered into or made by that shareholder or that associate, the effect or intent of which is to mitigate loss, manage risk or benefit from share price changes or to increase or decrease the voting power of that shareholder or that associate, in any case with respect to any share of Common Stock;

•a description of all arrangements and understandings between that shareholder or that associate and each proposed nominee of that shareholder and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by that shareholder;

•a representation by that shareholder that he or she intendsthey intend to appear in person or by proxy at that meeting to nominate the person(s) named in that nomination notice;

•a representation as to whether that shareholder or that associate, if any, intends, or is part of a group, as Rule 13d-5(b) under the Exchange Act uses that term, which intends, (i)(1) to deliver a proxy statement and/or form of proxy to the holders of shares of Common Stock havingrepresenting at least the percentage67% of the total votesvoting power of the holders of all outstanding shares of Common Stock entitled to vote in the election of each proposed nominee of that shareholder which is requireddirectors in accordance with Exchange Act Rule 14a-19, (2) to elect that proposed nominee and/or (ii) otherwise to solicit proxies or votes in support of the nomination;nomination, or (3) to engage in a solicitation with respect to the nomination and, if so, the name of each participant in such solicitation; and

•any other information relating to that shareholder and that associate that is required to be disclosed under Section 14 of the Exchange Act and the related SEC rules and regulations, in connection with solicitations of proxies for an election of a director.

In addition, the nomination notice must include a representation that the shareholder will notify us in writing of any change in any of the information referenced above as of the record date for the meeting of shareholders to which the nomination relates promptly following the later of that record date or the date notice of that record date is first publicly disclosed. We may require any person a shareholder proposes to nominate for election as a director under the provisions described above to furnish additional written information to determine the eligibility of that person to serve as a director. Unless otherwise required by law, if any shareholder provides a nomination notice pursuant to Exchange Act Rule 14a-19(b) and subsequently either (x) notifies us that such shareholder no longer intends to comply with Exchange Act Rule 14a-19(a)(3) or (y) fails to comply with the requirements of Exchange Act Rule 14a-19(a)(2) or Exchange Act Rule 14a-19(a)(3) (or fails to timely provide reasonable evidence sufficient to satisfy us that such shareholder has met the requirements of Exchange Act Rule 14a-19(a)(3)), then we shall disregard any proxies or votes solicited for such proposed nominees. If any shareholder provides a nomination notice pursuant to Exchange Act Rule 14a-19(b), such nominating shareholder shall deliver to us, not later than five (5) business days prior to the applicable meeting, reasonable evidence that it has met the requirements of Exchange Act Rule 14a-19(a)(3).

To be timely for consideration at our 20192025 Annual Meeting, a shareholder’s nomination notice must be received at our principal executive offices, 11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-3000,77086, addressed to our Corporate Secretary, not earlier than November 5, 201811, 2024, and not later than the close of business on January 4, 2019.February 9, 2025.

LEADERSHIP STRUCTURE AND BOARD RISK OVERSIGHT

We currently have a leadership structure that includes separate individuals serving as our Chief Executive Officer and ChairmanChair of our Board. Our Board believes this structure is appropriate in the existing circumstances, as Mr. Larson, our President and Chief Executive Officer, and Mr. Huff, ChairmanMcEvoy, Chair of our Board, currently serve our company in separate and distinct roles. Our Board believes it is appropriate to retain the flexibility to combine those

two positions in the future, should future circumstances result in a situation in which our Board determines that such a combination is appropriate.

The members of each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance & Sustainability Committee include only persons whom the Board has affirmatively determined are independent.independent and who are not and were not previously employed by or otherwise affiliated with Oceaneering. None of the Chairmenchairs of our Board committees serves as chairmanchair of more than one of those committees. As discussed above, our Board of Directors has determined that all members of the Audit Committee are financially literate and Ms. Goodwin and Mr. Murphy are audit committee financial experts as defined in the applicable rules of the SEC.SEC and the NYSE. Although our Board believes the current membership and leadership structure for our Board committees are appropriate in the existing circumstances, our Board also believes it is appropriate to retain the flexibility to change Board committee memberships and leadership structure in the future, should future circumstances warrant such a change in the view of our Board.

The risk oversight role of our Board and its committees is set forth in our Corporate Governance Guidelines and respective committee charters. Our Board and its committees are actively involved in the oversight of risks applicable to Oceaneering through oversight of our enterprise risk management program. Our Board oversees our:our risks associated with:

financial-•our operations, workforce, markets and compliance-related risksstrategy;

•compliance and financial matters, and cybersecurity matters, including the current and emerging cybersecurity threat landscape and regulatory updates, with the assistance of the Audit Committee;

risks associated with•ESG matters, including climate change and sustainability, public policy, our Board and executive officer leadership and succession, conflicts of interest, and more generally with the adequacy of our governance policies and procedures, with the assistance of the Nominating and Corporate Governance & Sustainability Committee; and

risks associated with •compensation policies and practices for executive officers and key employees, with the assistance of the Compensation Committee.

Our Compensation Committee considers, in establishing and reviewing compensation programs, whether the programs encourage unnecessary or excessive risk-taking. Based on analyses conducted by management and discussed with the Compensation Committee, we do not believe that our compensation programs for our executives and other employees are reasonably likely to have a material adverse effect on us. Our Board believes that the current structure of our Audit Committee with(with all members being independent and financially literate and two members being audit committee financial experts,experts), our Governance & Sustainability Committee and our Nominating and Corporate Governance Committee and Compensation Committee, with all members being independent, provides for an efficient and effective means of overseeing these risks. Our Board also oversees our strategic and operations-related risks. Our Board believes that the relative levels of experience and independence of our Board members, collectively, support the Board’s ability to effectively oversee these risks.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

Oversight

Our Board, with the assistance of its committees and our executive management team, oversees the development and implementation of our business strategies and matters involving the identification and management of risks, including risks related to long-term sustainability. This oversight is built around our Core Values:

•Do Things Right – We work safely and act with integrity in the best interest of our industry partners, employees and the environment.

•Solve Complex Problems – We provide products and services that work through listening, experience and curiosity.

•Grow Together – We collaborate, respect and support each other so we can reach our full potential.

•Outperform Expectations – We perform with excellence to serve our customers and each other.

•Own the Challenge – We hold ourselves accountable for the promises we make and work we do.

Our Core Values and culture reflect our commitments to safety, diversity and inclusion, human health, the environment, ethical business practices, and responsible corporate citizenship in the communities in which we live and work around the world. In 2023, our Board considered and discussed matters related to our sustainability during each of its regularly scheduled quarterly meetings. These discussions covered, among other things, our strategies for maintaining focus on human health and safety; attracting, diversifying, retaining and developing our human capital resources; establishing and monitoring the performance of our compensation and benefits programs; growing our business in strategic opportunity areas (including in non-energy markets); and expanding sustainable services and products for our customers and other ongoing ESG efforts.

Our Governance & Sustainability Committee has oversight responsibility for sustainability matters that include monitoring and advising the Board with respect to such matters; engaging on topics related to Oceaneering’s sustainability program, climate change and the environment; and overseeing Oceaneering’s public reporting on ESG matters. Our Audit Committee has oversight responsibility for Oceaneering’s financial statements, and therefore reviews the use of any “non-GAAP financial measures,” including ESG and related metrics. Management provides regular updates to the Governance & Sustainability Committee, the Audit Committee and the Board with respect to these matters.

Our Governance & Sustainability Committee:

•reviews our internal compliance with both internally established and externally applicable sustainability codes and principles across all business units;

•reviews our compliance with ESG matters and analyses related to the impacts of environmental and social trends and uncertainties on our business;

•oversees major decisions to specifically assess exposure to, and management of, sustainability-related risks, including climate risk;

•provides input to our executive management team regarding the determination of materiality of sustainability issues for the purposes of public disclosure;

•receives advice from internal and external sources, including our management-level sustainability committee and third-party consultants, and reports regularly to the Board; and

•approves external reporting on ESG matters.

Energy Transition

Today, Oceaneering generates a substantial majority of its revenue from the oil and gas sector. Our outlook, and pace of increasing industry diversification, depends to a large degree on the ongoing demand for oil and natural gas products and services. We consider and rely on information from third-party advisors and sources as well as our own views on the principal drivers of demand for oil and gas. Due to the continuing development of economies in developing countries, substantial projected population growth (particularly in developing countries), and the shortage of other sources of affordable, reliable, scalable and efficient energy, as well as rising worldwide demand for a myriad of products made with petrochemicals, we expect that the need for additional oil and gas exploration and development will continue for decades to come. At the same time, due to increasing concerns about climate change, there is growing demand for cleaner hydrocarbon-based and renewable energy sources.

Our assessment of the current and future demand for oil and gas is continually evolving and includes consideration of the following:

•Economic indicators (e.g., gross domestic product growth, income levels, industrial activity in key economies, changes in global trade);

•Capacities of electricity generation and transmission and petroleum refining;

•Use indicators (e.g., global vehicle fleet, motor vehicle sales (by type), vehicle miles traveled, airline passenger miles);

•Exogenous market influences (e.g., taxes and subsidies, regulatory and other pressures that may impact customer decision-making);

•Competition from potential substitute products;

•Geopolitical trends; and

•Other trends that could affect energy consumption (e.g., consumer preferences and urbanization).

We strive to meet the growing need for lower-carbon energy by assisting customers to reduce their carbon emissions in exploring for, developing and producing oil and natural gas, while also diversifying our business into new strategic growth areas in emerging energy and non-energy markets.We are also committed to reducing our own energy consumption and the greenhouse gas emissions attributable to our operations. In 2023, we announced our 2030 greenhouse gas Scope 1 and Scope 2 emission reduction targets against a 2022 baseline, along with our intended plans to achieve such goals. These goals are made using various underlying assumptions and reflect our current intentions. These goals are subject to change at any time and do not constitute a guarantee that they will be achieved.

ESG Reporting

We share the climate change concerns of our communities and our stakeholders, and we are actively engaged in the energy transition in order to mitigate our environmental impact and enable a lower-carbon future.

We voluntarily disclose key ESG matters and other metrics, consistent with the Sustainability Accounting Standards Board (“SASB”) voluntary disclosure framework and the Task Force on Climate-Related Financial Disclosures guidance. Our annual SASB disclosures and our Task Force on Climate-Related Financial Disclosures (TCFD) Report are available on our website at: www.oceaneering.com under “Sustainability.” Unless specifically stated herein, documents and information on our website are not incorporated by reference into this proxy statement.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our Board. None of our executive officers serves as a member of the board of directors of any other company that has an executive officer serving as a member of our Compensation Committee. None of our directors or executive officers are members of the same family.

CODE OF ETHICS

Our Board of Directors adopted a code of ethics that applies to our Chief Executive Officer and senior financial officers, including our Chief Financial Officer, Chief Accounting Officer, Treasurer or Controller, and a code of business conduct and ethics that applies to all our directors, officers directors and employees. Each is available onunder the Governance pagetab in the Investor RelationsInvestors section of our Web sitewebsite (www.oceaneering.com). Any shareholder may obtain a printed copy of these codes from us upon request. Any change in or waiver of these codes of ethics will be disclosed on our Web site.website.

DELINQUENT SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEREPORTS

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of our Common Stock to file with the SEC and the NYSE initial reports of ownership and reports of changes in ownership of Common Stock. Based solely on a review of the copies of such reports furnished to usfiled electronically with the SEC and representations that no other reports were required, we believe that all our directors and executive officers complied on a timely basis with all applicable filing requirements under Section 16(a) of the Exchange Act during 2017,2023, except that Mr. Eric A. Silva, our Senior Vice President, Operations SupportMcDonald filed a Form 4 that reported, after the time prescribed, a purchasesales of Common Stock by him and Mr. Robert P. Moschetta, our Senior Vice President, Health Safety Environment/Training/Quality, filed a Form 4 that reported, after the time prescribed, a salehim.

REPORT OF THE AUDIT COMMITTEE

During the year ended December 31, 2017,2023, the Audit Committee of Oceaneering International, Inc.’sour Board of Directors was comprised of the directors named below. Each member of the Audit Committee is an independent director as defined by applicable Securities and Exchange Commission rules and New York Stock Exchange listing standards. The Audit Committee met eightseven times during the year ended December 31, 2017.2023. The Audit Committee reviewed and discussed with management and Ernst & Young LLP, Oceaneering’s independent registered public accounting firm, all of Oceaneering’s earnings releases in 20172023 prior to the public release of those earnings releases. In addition, the Chairmanchair of the Audit Committee reviewed and discussed with management the interim financial information included in Oceaneering’s quarterly reports on Form 10-Q for the periods ended March 31, 2017, 2023, June 30, 20172023, and September 30, 2017,2023, prior to their being filed with the Securities and Exchange Commission.

The Audit Committee reviewed and discussed with management and Ernst & Young Oceaneering’s consolidated financial statements for the year ended December 31, 2017.2023. Members of management represented to the Audit Committee that Oceaneering’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee discussed with Ernst & Young matters required to be discussed under the standards of the Public Company Accounting Oversight Board. The Audit Committee also reviewed and discussed, with management and Ernst & Young, our management’s report and Ernst & Young’s report on internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act.

Ernst & Young provided to the Audit Committee the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young’s independence, and the Audit Committee discussed with Ernst & Young theirits independence from Oceaneering. The Audit Committee concluded that Ernst & Young’s provision of non-audit services to Oceaneering and its affiliates is compatible with Ernst & Young’s independence.

Based on the Audit Committee’s discussions with management and Ernst & Young and the Audit Committee’s review of the items referred to above, the Audit Committee recommended to Oceaneering’s Board of Directors that Oceaneering’s audited consolidated financial statements as of and for the year ended December 31, 20172023, be included in theour Annual Report on Form 10-K for the year ended December 31, 20172023, filed with the SEC.

| | | | | | | | |

| | |

| | Audit Committee |

| | Paul B. Murphy, Jr., Chairman William B. Berry

Jon Erik Reinhardsen

Chair |

| | Karen H. Beachy |

| | Deanna L. Goodwin |

PROPOSAL 2

ADVISORY VOTE ON A RESOLUTION TO APPROVE

THE COMPENSATION OF OCEANEERING’S NAMED EXECUTIVE OFFICERS

As required by Section 14A(a)(1) of the Exchange Act, we are providing our shareholders the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our Named Executive Officers (including, for purposes of this proposal, our Former Chief Executive Officer) as disclosed in this Proxy Statement.

In makingsetting executive compensation decisions,programs, the Compensation Committee of our Board takes into account alignment of Directors considers all elementsthe compensation program with achievement of compensation when setting each element of compensation. Thethe Company’s short- and long-term strategic plans. In addition, the Compensation Committee assesses each element of base salary, annual incentive bonus, long-term incentive compensation and retirement plan value against a combination of available information from the most recent proxy statements of a peer group of publicly traded companies and survey data from the energy and general industries.industries to assess market competitiveness.

As described in detail under the “Compensation Discussion and Analysis” section of this Proxy Statement below, our compensation program for Named Executive Officers is designed designed:

•to attract, retain and motivate key executives and to deliver a competitive package that is aligned with our shareholders’ interests, while at the same time avoiding the encouragement of unnecessary or excessive risk taking.taking; and

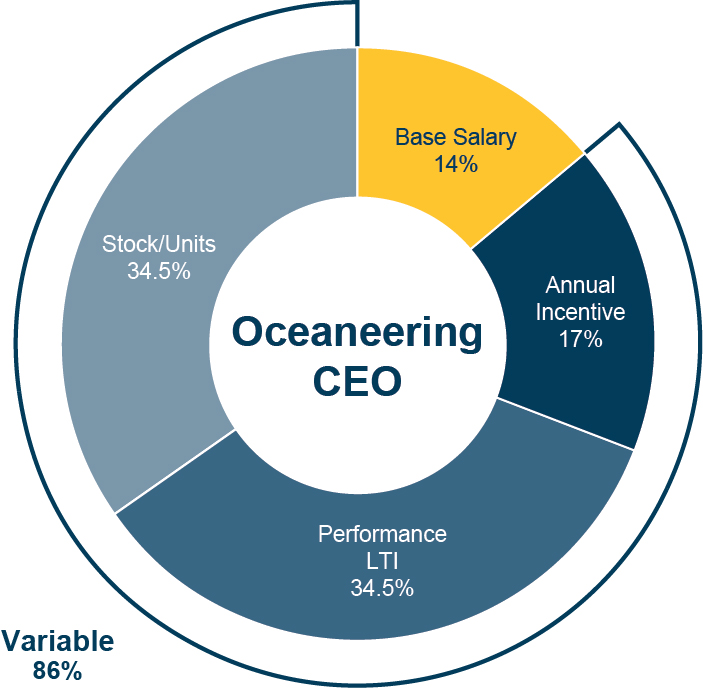

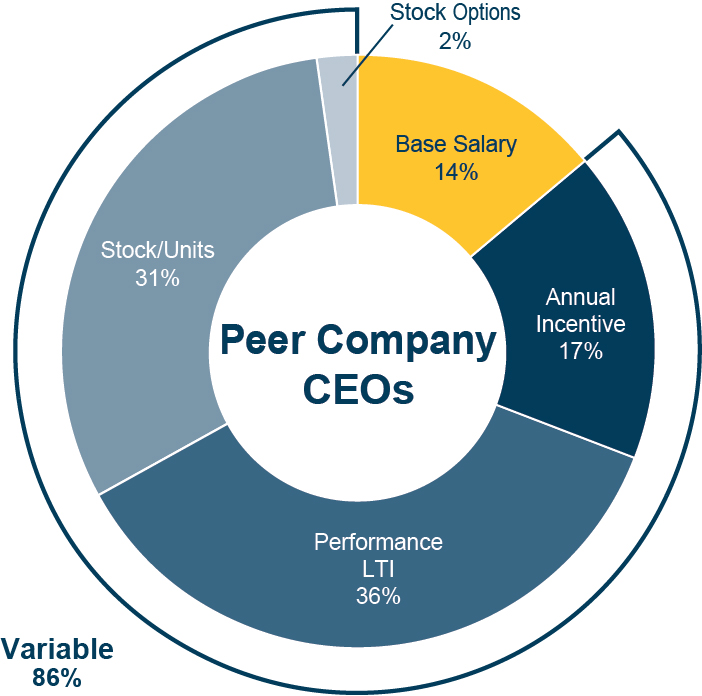

A•to deliver a significant portion of ourthat compensation program is delivered through variable compensation elements that are tied to key performance objectives. Generally, at leastapproximately one-half of the 2017 target total direct compensation (annual salary, annual incentives and long-term incentives) of our Named Executive Officers is performance-basedperformance-based.

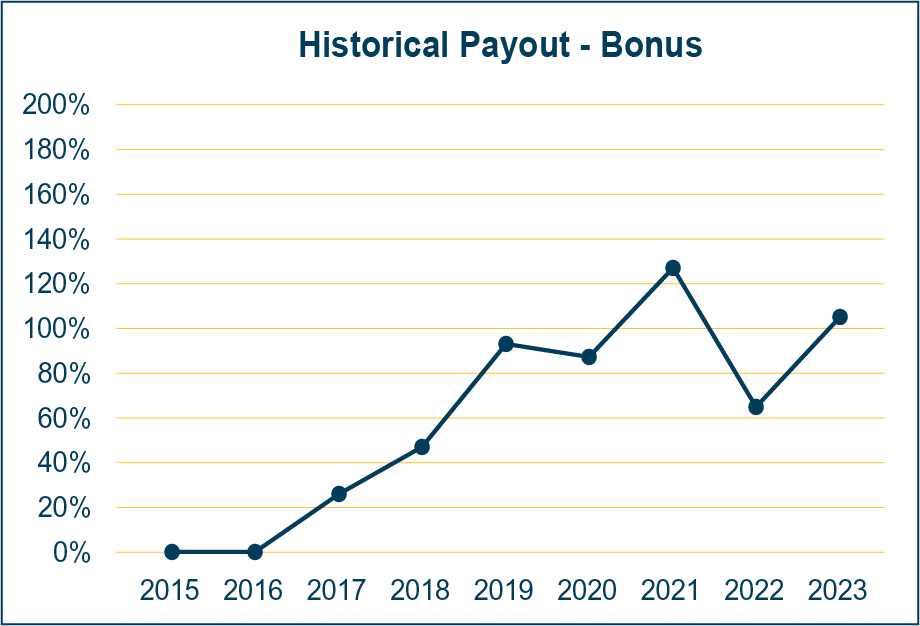

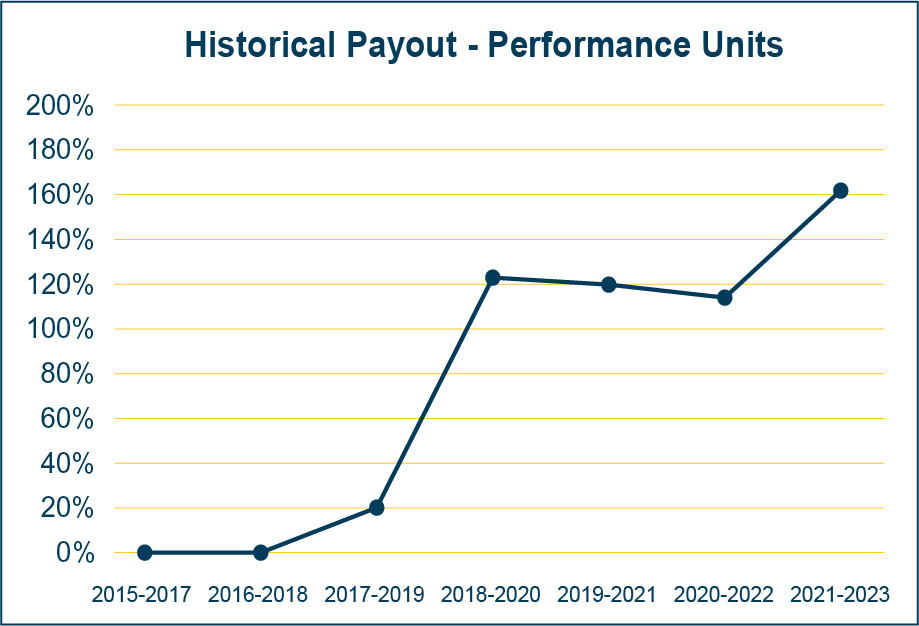

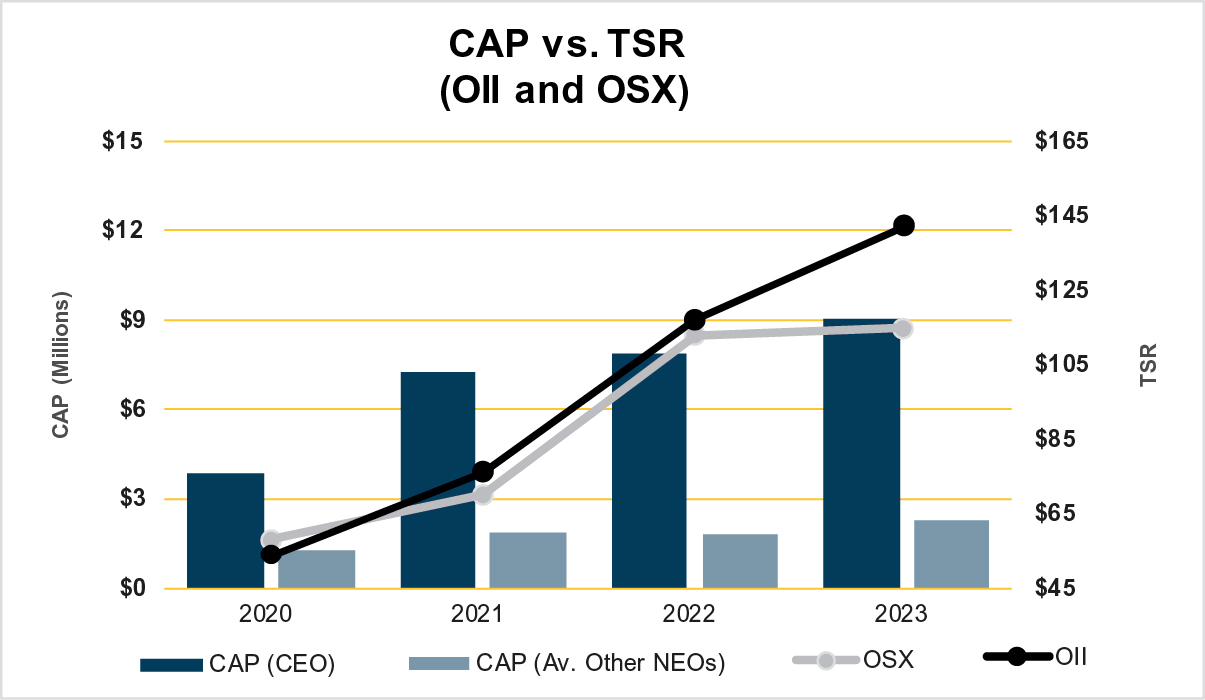

In 2023, we achieved growth primarily through hiring, training and approximately 60%retaining personnel to meet the dynamic demands of offshore energy operations, continual improvement toward our operational excellence goals, and maintaining many of the estimated grant date valuecost reduction efforts implemented in prior years. As a result, we delivered positive financial performance and shareholder return resulting in above-target payouts under our 2023 annual bonus program and our 2021 long-term performance unit program.

Notable achievements in 2023 included:

•growing consolidated revenue to $2.4 billion, an increase of their long-term incentive awards is performance-based.17% over 2022;

Achievement•increasing net income to $97 million and consolidated operating income to $181 million, reflecting year-over-year increases of specific financial goals below threshold275% and 64%, respectively;

•improving our gross margin to $399 million in 2023, an increase of 30% over 2022, driven by year-over-year improvements in our Subsea Robotics and Manufactured Products segments;

•achieving a cumulative total shareholder return of 36% for 2023 and 173% for the three-year performance period ended December 31, 2023;

•generating net cash flow from operations of 2015-2017 resulted in there being no long-term incentive performance unit cash payouts for any participating employees. Compared to 2016, our operating income for 2017 declined 85%. Accordingly, we have continued a series of initiatives we started in 2015 to align our operations with current$210 million and anticipated activity and pricing levels, which have necessarily included workforce reductions, incurring unusual expenses and making certain accounting adjustments. Despite these challenges, notable achievements in 2017 included:

each of our operating segments was profitable, achieving operating income of $11 million;

declaring cash dividends aggregating to $44 million, or $0.45 per share;

continuing substantial investments in opportunities to expand our business, with 2017 capital expenditures of approximately $105 million (including $11 million on acquisitions/investments);

ending the year with a subsea products backlog of $276 million; and

maintaining an appropriately capitalized balance sheet with $752 million of working capital, including $430 million of cash and cash equivalents $800on our balance sheet of $462 million, ofwhile investing $101 million in capital expenditures without drawing on our revolving credit facility;

•reducing our long-term debt and $1.7 billionto $500 million from $700 million by retiring our 2024 senior notes, using proceeds from our 2023 debt offering together with cash on hand;

•increasing backlog in our Manufactured Products segment to $622 million as of equity at December 31, 2017.2023, from $467 million as of December 31, 2022, an increase of $155 million, or 33%, contributing to a consolidated backlog as of December 31, 2023, of $2.3 billion;

•advancing our ESG commitment, especially in terms of our greenhouse gas emission reduction targets published in our annual Task Force on Climate-Related Financial Disclosures (TCFD) Report, available on our website, and continuing our diversity, equity & inclusion efforts; and

•continuing to advance our innovative robotics, automation and remote-operations solutions to assist our energy and non-energy customers in reducing their carbon footprint and enhance safety and efficiency, including through our Freedom next-generation hybrid (“ROV”) and autonomous underwater vehicle, designed to provide remote subsea inspection, maintenance and repair services, which performed its first commercial project in 2023; our MaxMoverTM autonomous counterbalance forklift, which saw a 266% year-over-year increase in orders; and our autonomous people-mover solutions.

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the compensation of the Named Executive Officers as described in this Proxy Statement in accordance with the rules of the SEC. As an advisory vote, it is not binding. However, our Board of Directors and our Compensation Committee, which is responsible for designing and overseeing the administration of our executive compensation program, and our Board will consider the outcome of the vote when making futureas an indicator of how well our compensation decisions forphilosophy and programs align with the interests of our executive officers.shareholders.

Accordingly, we ask our shareholders to vote on the following resolution:

RESOLVED, that Oceaneering’s shareholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in Oceaneering’s Proxy Statement for its 20182024 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 20172023 Summary Compensation Table and the other compensation-related tables and accompanying narrative disclosures.

In accordance with our Bylaws, the adoption of this proposal requires the affirmative vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote on the proposal at the 20182024 Annual Meeting of Shareholders.

Because abstentions are counted as present for purposes of the vote on this proposal, but are not votes “FOR” this proposal, they have the same effect as votes “AGAINST” this proposal. Broker non-votes“non-votes” will have no effect on this vote.

Our Board of Directors unanimously recommends a vote FOR the approval of the compensation of our Named Executive Officers as disclosed in this Proxy Statement.

The persons named in the accompanying proxy intend to vote such proxy FOR approval of the compensation of our Named Executive Officers unless a choice is set forth therein or unless an abstention or broker “non-vote” is indicated therein.

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis contains statements regarding future individual and company performance goals and measures. These goals and measures are disclosed in the limited context of Oceaneering’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. Oceaneering cautions investors not to apply these statements to other contexts.

The following Compensation Discussion and Analysis, or “CD&A,” provides information regarding the compensation programs in place for our current Chief Executive Officer, Chief Financial Officer, and three other most highly compensated executive officers during 2017.2023. We refer to these individuals in this Proxy Statement as the “Named Executive Officers.” In addition, this CD&A provides some compensation-related information for our former Chief Executive Officer, Mr. Kevin McEvoy, who retired in May 2017 (our “Former Chief Executive Officer”). This CD&A also includes information regarding, among other things, the objectives of our compensation program, the achievements that the compensation program is designed to reward, the elements of the compensation program (including the reasons why we employ each element and how we determine amounts paid) and how each element fits into our overall compensation objectives. As used in this CD&A, references to the “Committee” mean the Compensation Committee of our Board of Directors.Board.

Executive Summary

Our executive compensation program is designed to attract, retain and motivate key executives and to deliver a competitive package to our executive officers that is aligned with our shareholders’ interests. When considering our program, we believe it is important to note:

•the primary components of our compensation program consist of annual base salary, annual incentives, long-term incentives and retirement plans that are designed in the aggregate to provide opportunity that is competitive with the 50th percentile of a peer group and survey data identified by the Compensation Consultant retained byas described in “— The Role of the Committee;Compensation Consultant” below;

•a significant portion of the program is delivered through variable compensation elements that are tied torequire achievement of certain key performance objectives of Oceaneering. Generally, at leastindicators, such that approximately one-half of the target total direct compensation (annual salary and annual and long-term incentives at target levels) is performance-based and approximately 60%performance-based;

•a significant portion of the estimated grant date valueprogram is delivered through restricted stock units or otherwise tied to the performance of long-term incentive awards is performance-based;the Company’s Common Stock, such that executives are incentivized toward achievement of shareholder returns;

the worldwide slump•through 2023, we intensified our focus on growth and hiring, training and retaining, leveraging our operational excellence programs, while continuing to focus on health, safety and environmental impacts in oil prices from 2014 levelsour operations, with results including:

–maintaining our strong focus on health and resulting slowdownsafety, particularly on life-saving rules, high-hazard tasks and engineered solutions;

–growing consolidated revenue 17% to $2.4 billion and achieving improvements, compared to 2022, of 275% in deepwater activity continued to impactnet income, 64% in operating income and 30% in gross margin, with a consequent increase of $56 million or 24% in Adjusted EBITDA for 2023 (as defined in our business and financial results and, accordingly, negatively affected the annual and long-term incentive programs);

–achieving a total shareholder return of 36% for 2023 and 173% for the three-year performance period ended December 31, 2023;

–maintaining strong liquidity by reducing our long-term debt from $700 million to $500 million, while retaining cash and cash equivalents on our balance sheet of $462 million and increasing capital investment 24% year over year, without drawing on our revolving credit facility;

–advancing our ESG commitment, especially in terms of our greenhouse gas emission reduction targets published in our annual Task Force on Climate-Related Financial Disclosures (TCFD) Report, available on our website, and continuing our diversity, equity & inclusion efforts; and

–continuing to advance our innovative robotics, automation and remote-operations solutions to assist our energy and non-energy customers in reducing their carbon footprint and enhance safety and efficiency.

To assist the Committee in setting compensation of the Named Executive Officers;

annual incentive payouts for the Named Executive Officers for 2017 were approximately 26% of target amounts, reflecting achievement of positive cash flow between threshold and target levels and attainment of health, safety, environmental protection and quality goals at target; and

there were no payouts to2023, the Named Executive Officers under our 2015 long-term incentive performance unit program,Compensation Consultant as the threshold level of performance for the period of January 1, 2015 through December 31, 2017 was not attained for either average return on invested capital or cumulative cash flow.

Meridian Compensation Partners, LLC, the compensation consultant retained by the Committee (the “Compensation Consultant”), performed, among other things, an assessment of:

the continued validitydescribed in “— The Role of the peer group of companies used for comparison purposes in the preceding year;

Compensation Consultant” below assessed the competitiveness of cashOceaneering’s executive compensation equity awards, retirement benefits and perquisites provided to our executive officers and other key employeesprogram relative to our peer groupindustry benchmarks, and energy industry survey data;

Oceaneering’s performance relative to our peer group in termsthe alignment of our Chief Executive Officer’s annual cash bonus payout; and

Oceaneering’s incentive structure for executive officers.

The Compensation Consultant assessed that:

the peer group selected by the Committee was appropriate;

the target total direct compensation of most Oceaneering executives was at or below the relevant 50th percentile of the peer group;

executive compensation and Oceaneering’s performance were generally aligned in favor of our shareholders’ interests; and

Oceaneering’s incentive structure for its executive officers was generally alignedthat program with Oceaneering’s compensation philosophy and objectives, and market practices, although Oceaneering’sadvised that:

•certain changes to the peer group were recommended for use by the Committee in setting the compensation of the Named Executive Officers (see “— Compensation Peer Group” below);

•amounts realized from our executive compensation has placed more emphasis than its peers on annualprogram were generally aligned with Oceaneering’s performance; and

•our mix of salary, bonus and long-term incentives meeting absolute performance goals, limiting upside leverage, and denominating long-term performance awards in cash.for Named Executive Officers aligns closely with our peers.

Compensation Philosophy and Objectives

Our executive compensation program is designed to attract and retain key executives, motivate them to achieve our short-term and long-term objectives without exposing us to excessive or unnecessary risk, and reward them for superior performance. We use several different compensation elements in the executive compensation program that are geared to both our short-term and long-term performance. The following principles influence the design and administration of our executive compensation program.

Compensation Should Be Related to Performance

The Committee and our Board of Directors believe that a significant portion of an executive officer’s direct compensation should be tied to overall company performance and measured against financial goals and other performance-based objectives.

Under the performance-based portions of our compensation arrangements, our basic philosophy is that, in the absence of special circumstances, Named Executive Officers should be paid more than the target awards in years when performance is better than the objectives established for the relevant performance period, Named Executive Officersand should be paid moreless than the target awards and, when our performance does not meet planned objectives, incentive award payments should be less than such targets, in the absence of special circumstances.objectives.

Compensation Programs Should Motivate Executives to Remain Withwith Us

We believe that there is significant value to our shareholders forwhen our executive officers to remain with our company over time. Ourtime, because our business success and growth depend on leadership by executives with a keen understanding of our services and products and the markets we serve, and by executives who can develop and maintain strong customer relationships over time. Also, value is built by executives who understand the unique business and technical aspects of our industry. For these reasons, a significant part of our executive compensation arrangements historically has been a combinationare comprised of long-term incentive compensation arrangements, withincluding awards that have provided for vestingvest over several years. In addition, to promote long-term retention, we provide our executive officers with incentives to remain focused on their duties in the event of any change of control, including some financial security in the event of a change of control. We also provide for long-term benefits through retirement plans (see “— Executive Compensation Components — Post-Employment Compensation Programs”Programs” below).

Incentive Compensation Should Represent a Significant Part of an Executive’s Total Direct Compensation

We believe that the portion of an executive officer’s total compensation that varies with our overall performance objectives should increase as the scope and level of the individual’s business responsibilities and role in the organization increase. We believe that generally, at leastapproximately one-half of the target total direct compensation (the sum of annual base salary and annual incentive bonus and long-term incentive compensation at target levels) of our executive officers should be at risk against short- and long-term performance goals, and our Chief Executive Officer should be subject to a greater amount of such risk than other executive officers.

Incentive Compensation Should Balance Short-Term and Long-Term Performance

We strive to maintain an executive compensation program that balances short-term or annual,(annual) results and long-term results. To reinforce the importance of this balance, we regularly provide our executive officers both annual and long-term incentives. We believe we should avoid disproportionately large short-term or annual(annual) incentives that could encourage our executive officers to take excessive and unnecessary risks. The value for participants in our long-term incentive programs generally increases at higher levels of responsibility, as executives in these leadership roles have the greatest influence on our strategic direction and results over time.

The Committee’s approach to long-term incentives is to make both service- and performance-based awards to our executive officers and other key employees. The service-based awards have consisted of restricted stock units, and the performance-based awards have consisted of performance units. The long-term incentive awards are scheduled to vest in full on the third anniversary of the award date, subject to earlier vesting as described below under “— Executive Compensation Components — Long-Term Incentive Compensation.Compensation.” The Committee believes that performance-based awards, valued at target level, should account for approximately 60% of the total annualtarget value of long-term incentive compensation of the Named Executive Officers should be divided equally between performance-based awards and service-based awards should account for the balance.awards. For this purpose, the Committee assumes a value for restricted stock units based on the grant date value computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 – Stock Compensation (“FASB ASC Topic 718”) and performance units based on the value at target of $100 per unit. The Committee believes that this approach promotes our philosophy of rewarding executives for growing shareholder value over time. Upon vesting, settlement of the restricted stock units will beare made in shares of our Common Stock, with some shares withheld to satisfy tax withholding requirements. Upon vesting, the value of the performance units will beare paid in cash.

Compensation Levels Should Be Competitive